AZ Privilege Use Tax Return free printable template

Show details

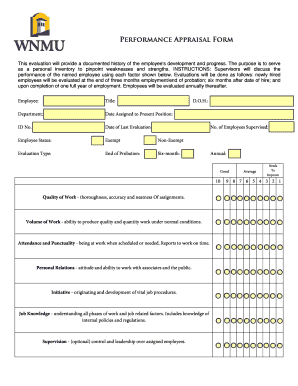

Print Form PRIVILEGE SALES and USE TAX RETURN City of Peoria Tax and License Section LICENSE NO. REPORTING PERIOD 8401 W. Monroe Street Peoria AZ 85345 Phone 623 773-7160 Fax 623 773-7383 Email salestax peoriaAZ. gov http //www. peoriaAZ. gov/salestax Business Name DUE DATE Deduction Note Tax Rates as of July 1 2014 Retail Food If you are claiming a deduction be sure to Utilities write it on the second page. If your deduction Hotel/Motel code is 75-77 include a 1 or 2 word Amusements...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ Privilege Use Tax Return

Edit your AZ Privilege Use Tax Return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ Privilege Use Tax Return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AZ Privilege Use Tax Return online

To use the services of a skilled PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ Privilege Use Tax Return. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out AZ Privilege Use Tax Return

How to fill out AZ Privilege & Use Tax Return

01

Obtain the AZ Privilege & Use Tax Return form from the Arizona Department of Revenue website or your local tax office.

02

Fill in your business information, including your business name, address, and identification number.

03

Indicate the reporting period for which you are filing the return.

04

Calculate the total gross income from taxable sales or services provided.

05

Determine the applicable tax rate and calculate the privilege tax due based on your gross income.

06

Document any deductions you may qualify for and subtract them from your gross income to determine the taxable amount.

07

Complete the use tax section if applicable, detailing any out-of-state purchases not taxed in Arizona.

08

Total your calculated privilege tax and use tax to determine the total amount due.

09

Sign and date the return to certify its accuracy and completeness.

10

Submit the completed form and payment by the due date to avoid penalties.

Who needs AZ Privilege & Use Tax Return?

01

Businesses operating in Arizona that have gross receipts from taxable activities.

02

Companies that receive income from renting or leasing tangible personal property.

03

Individuals or businesses that acquire property subject to use tax within Arizona.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify AZ Privilege Use Tax Return without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including AZ Privilege Use Tax Return, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send AZ Privilege Use Tax Return for eSignature?

When you're ready to share your AZ Privilege Use Tax Return, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my AZ Privilege Use Tax Return in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your AZ Privilege Use Tax Return and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

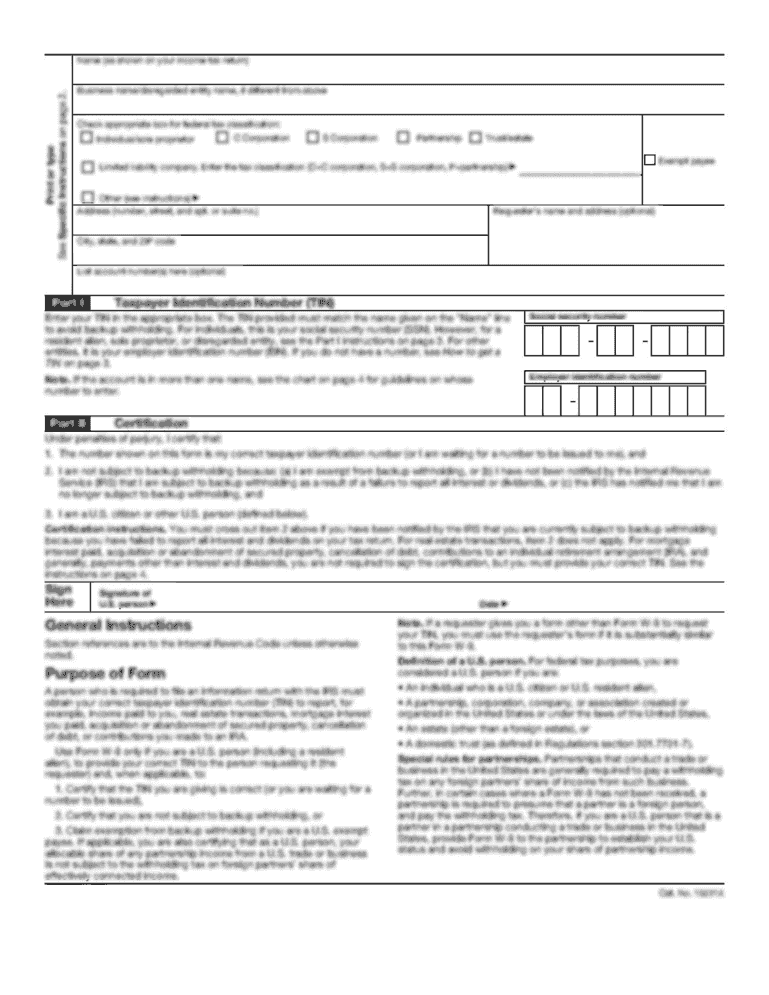

What is AZ Privilege & Use Tax Return?

The AZ Privilege & Use Tax Return is a tax form used by businesses in Arizona to report and pay the state's privilege tax, which is levied on businesses for the privilege of conducting business in the state, as well as use tax on purchases for tangible personal property used in Arizona.

Who is required to file AZ Privilege & Use Tax Return?

All businesses operating in Arizona that sell tangible personal property or provide taxable services and those who purchase items for use in Arizona that were not taxed at the time of sale are required to file the AZ Privilege & Use Tax Return.

How to fill out AZ Privilege & Use Tax Return?

To fill out the AZ Privilege & Use Tax Return, businesses must provide their business information, report total sales, calculate the applicable tax based on the gross income, and report any use tax due for out-of-state purchases. The form requires accurate record-keeping of income and expenses.

What is the purpose of AZ Privilege & Use Tax Return?

The purpose of the AZ Privilege & Use Tax Return is to ensure that businesses comply with state tax laws by reporting their taxable sales and use tax liabilities, thus contributing to the state's revenue for public services and infrastructure.

What information must be reported on AZ Privilege & Use Tax Return?

The AZ Privilege & Use Tax Return must report the business name, address, transaction amounts, total sales, tax rate, total tax due, and any deductions or exemptions claimed. It may also require details about the types of goods sold and services provided.

Fill out your AZ Privilege Use Tax Return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ Privilege Use Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.